Unlocking Success in Online Forex Trading A Comprehensive Guide

trading6 October 31, 2025

In the realm of financial markets, online forex trading has emerged as one of the most accessible and lucrative avenues for individuals looking to invest their capital. With the rise of technology and the internet, traders from all over the globe can now participate in the forex market, benefiting from the ability to trade currency pairs 24/5. As someone interested in exploring this domain, you’ll need to arm yourself with knowledge, tools, and strategies to navigate the complexities of currency trading successfully. If you’re looking for a trusted platform, consider trading online forex Islamic Trading Platform to get started.

Understanding Forex Trading

Foreign Exchange (Forex) trading involves the buying and selling of currency pairs, where one currency is exchanged for another. The forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion. Unlike the stock market, forex trading is decentralized, meaning it doesn’t have a central exchange. Instead, trading occurs over-the-counter (OTC) through a network of banks, brokers, and financial institutions.

The Basics of Currency Pairs

In forex trading, currencies are quoted in pairs, with the first currency being the base currency and the second the quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. A quote of 1.1200 means that 1 euro can be exchanged for 1.12 US dollars. Understanding these pairs is crucial for analyzing price movements and making informed trading decisions.

Types of Currency Pairs

There are three main types of currency pairs:

- Major pairs: These include the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD. They often have high liquidity and lower spreads.

- Minor pairs: These pairs involve currencies that are less frequently traded, such as AUD/NZD or EUR/GBP. They may have wider spreads and lower liquidity.

- Exotic pairs: Involving a major currency and a currency from a developing economy, these pairs (e.g., USD/TRY) can have significant volatility and higher transaction costs.

Choosing a Forex Broker

Selecting the right forex broker is paramount for your trading success. A broker acts as an intermediary, providing access to the forex market. Here are some essential factors to consider when choosing a broker:

- Regulation: Ensure that the broker is regulated by a reputable authority to guarantee the safety of your funds and fair trading practices.

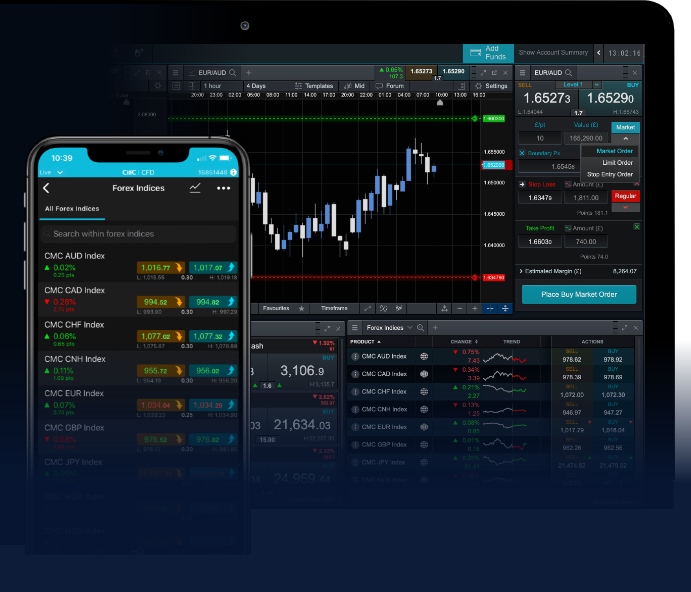

- Trading platform: The trading platform should be user-friendly, stable, and equipped with the necessary tools for analysis and execution.

- Spreads and commissions: Compare the spreads (the difference between buy and sell prices) and any commissions charged to identify the most cost-effective option.

- Customer support: Reliable customer support is crucial, especially for novice traders who may need assistance.

- Account types: Look for brokers that offer various account types to suit your trading preferences and strategies.

Developing a Trading Strategy

Having a robust trading strategy is essential for success in forex trading. Here are some common approaches traders use:

Technical Analysis

Technical analysis involves analyzing historical price movements and using chart patterns, indicators, and statistical measures to forecast future price trends. Traders may utilize tools like Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements to make informed decisions.

Fundamental Analysis

Fundamental analysis entails evaluating economic indicators, financial news, and geopolitical events that may impact currency values. Key factors include interest rates, inflation, and employment data. Understanding the underlying economic principles can help you anticipate market movements and make strategic trades.

Sentiment Analysis

Sentiment analysis looks at the overall mood of the market participants. Analyzing trader sentiment can provide insights into potential market reversals and trends based on the collective attitude of traders towards a specific currency.

Risk Management in Forex Trading

Effective risk management is critical in forex trading, as it helps protect your capital from significant losses. Implementing stop-loss orders, position sizing, and risk-reward ratios can safeguard your investments. Remember never to risk more than you can afford to lose, and ensure your trading strategy incorporates a clear risk management plan.

Staying Informed

The forex market is dynamic and constantly changing. Staying informed about economic news, market developments, and global events is crucial for making timely trading decisions. Consider subscribing to financial news outlets, using economic calendars, and following expert analysis to enhance your market knowledge.

Common Mistakes to Avoid

Many traders, especially beginners, fall into common pitfalls that can hinder their success. Here are a few mistakes to avoid:

- Lack of a trading plan: Trading without a clear plan can lead to emotional decision-making and impulsive trades.

- Over-leveraging: Using excessive leverage can amplify losses. Always use leverage wisely and understand its implications.

- Neglecting analysis: Failing to conduct proper analysis can result in uninformed trading decisions and losses.

- Ignoring risk management: Not implementing risk management strategies can put your entire trading account at risk.

Conclusion

Online forex trading offers exciting opportunities for potential profit, but it also requires thorough knowledge and understanding of the market. By choosing a reliable Islamic Trading Platform, developing a sound trading strategy, and maintaining disciplined risk management practices, you can navigate the forex market more effectively. Remember to keep learning and evolving your approach as you gain experience in this dynamic trading environment. Happy trading!

Contact Us

Contact Us